The Curve Conspiracy Sequel: Yield Basis: A New Paradigm for Stablecoin Yields

The Expansion of Stablecoin Trading Beyond Ethena

Follow @YBSBarker for expert guidance on yield strategies during the era of massive stablecoin credit expansion.

After the Luna-UST collapse, algorithmic stablecoins disappeared from the scene. The CDP model (DAI, GHO, crvUSD) was once the beacon of hope, but under pressure from USDT and USDC, it was Ethena and its yield-pegged system that broke out—sidestepping the capital inefficiency from over-collateralization and leveraging native yields to unlock new potential in DeFi.

In contrast, Curve built its initial DEX dominance on stablecoin trading, then expanded into lending with Llama Lend and launched its own stablecoin (crvUSD). Still, with Aave in the spotlight, crvUSD issuance has struggled to exceed $100 million, leaving it largely as a background player.

However, with Ethena, Aave, and Pendle all gaining momentum, Curve’s latest project, Yield Basis, is now seeking a slice of the growing stablecoin market—this time through leveraged trading. The goal: eliminate a long-standing AMM DEX problem—impermanent loss (IL).

Monosided Approaches to Eliminating Impermanent Loss

Curve’s latest creation: “Your BTC is now mine. Stand guard with your YB.”

Yield Basis is a DeFi renaissance rolled into one protocol—liquidity mining, pre-mining, the Curve War, staking, veTokens, LP Tokens, and leveraged looping. It’s a showcase of everything DeFi has become.

Curve founder Michael Egorov was an early AMM innovator, improving on Uniswap’s x*y=k formula by creating stableswap and cryptoswap algorithms for more efficient stablecoin trading and better capital performance.

Curve’s large-scale stablecoin trading cemented its early on-chain infrastructure role for USDC, USDT, DAI, and the like. Before Pendle came along, Curve was the most important venue for on-chain stablecoin activity. UST’s collapse was even triggered by liquidity leaving Curve.

Tokenomics-wise, Curve pioneered the veToken model and, with Convex’s “bribery” mechanism, turned veCRV into a real working asset. Yet, after four years of locking, most $CRV holders have little to show for it but pain.

Pendle and Ethena’s rise weakened Curve’s position. Why? Because for USDe, hedging happens on CEXs, yield is routed via sUSDe, and the core value of stablecoin trading itself has diminished.

Curve’s first counterstrike was the Resupply event in 2024, launched with Convex and Yearn Fi—an early giant move. Unsurprisingly, it blew up, marking Curve’s first real stumble.

Although Resupply wasn’t an official Curve project, its failure still damaged Curve’s reputation. If Curve doesn’t push back, it risks missing out on the next era of stablecoins.

True to form, Yield Basis doesn’t target stablecoins or lending markets directly, but the issue of impermanent loss in AMM DEXs. But let’s be clear: Yield Basis doesn’t actually aim to erase impermanent loss—it aims to blow up crvUSD issuance using that as a lever.

Let’s unpack impermanent loss. LPs (liquidity providers) replace traditional market makers by providing “two-sided liquidity” to AMM DEX pairs, incentivized by fee sharing. For a BTC/crvUSD pool, the LP must supply 1 BTC and 1 crvUSD (assuming 1 BTC = 1 USD) for a total value of $2.

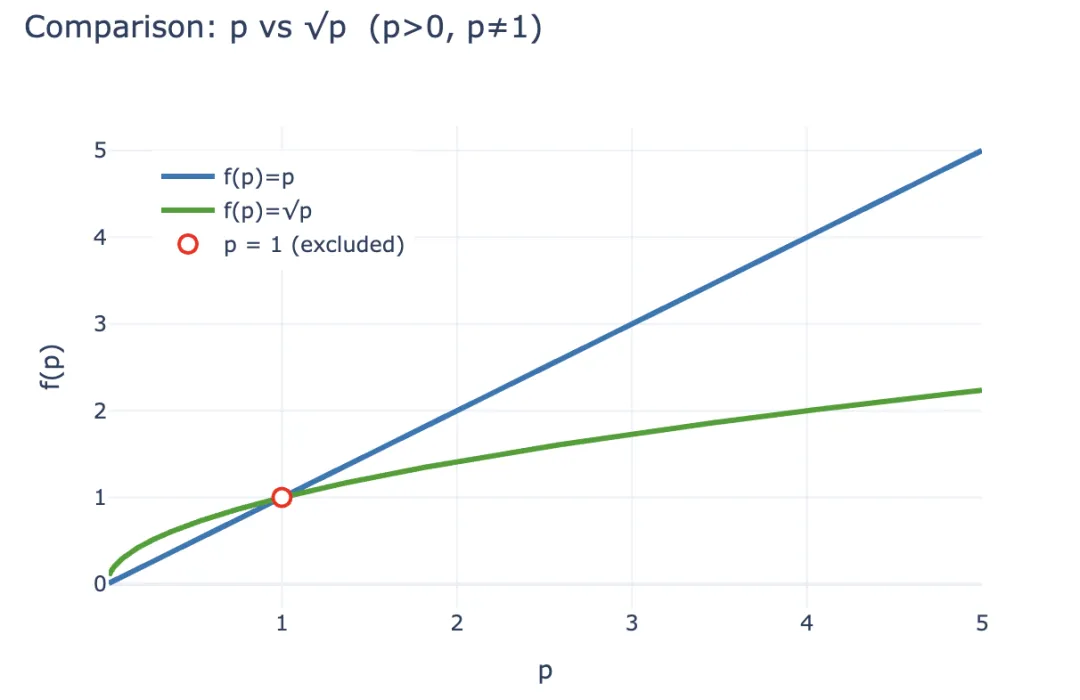

The price of 1 BTC, p, equals y/x. Set p = y/x. If BTC’s price doubles to $2, arbitrage opportunities emerge:

Pool A: Arbitrageurs spend $1 to buy 1 BTC. The LP sells BTC and ends up with $2.

Pool B: In Pool B, now worth $2, arbitrageurs can sell for a $1 profit ($2 - $1).

That profit comes out of Pool A’s LP’s pockets. Quantitatively, after arbitrage, the LP’s value is LP(p) = 2√p (with x and y both tied to p). If the LP just held 1 BTC + 1 crvUSD, their value would be LP_hold(p) = p + 1.

For p > 0 and p ≠ 1, the inequality 2√p < p + 1 always holds—arbitrage gains are straight from LP losses. Economics push LPs to withdraw and just hold assets, while AMMs must lure them back with higher fees and tokens. That’s why CEXs still dominate spot trading over DEXs.

Caption: Impermanent Loss

Source: @yieldbasis

Viewed across the entire on-chain economy, impermanent loss is more an expectation. By providing liquidity, LPs forgo the gains from purely holding. In reality, it’s more an “accounting” paper loss than anything economically tangible—LPs still earn trading fees compared to simply holding BTC.

Yield Basis turns that logic inside out. Rather than boosting liquidity or fees to offset LP losses, it focuses on “market-making efficiency.” Remember: relative to p+1 for holders, the LP’s 2√p always falls short. But from the ROI perspective, for an initial $2 investment now worth 2√p, your per-dollar “yield” is √p. If you just held, your return would be p.

Assuming a $2 starting investment and a 100% price gain, the LP’s changes are:

- • Absolute gain: $2 = 1 BTC ($1) + 1 crvUSD → $2√2 (arbitrageurs take the difference)

- • Relative yield: $2 = 1 BTC ($1) + 1 crvUSD → √2 USD

Yield Basis seeks to let LPs turn √p into p—keeping trading fees, plus the gains from holding. How? Just square it. That’s 2x leverage—anything more or less destabilizes the system.

Caption: p vs √p—How LP Value Scales

Source: @zuoyeweb3

In short, one BTC provides double the market-making power, with BTC the only return benchmark—no sharing with crvUSD. The return jumps from √p to p.

Believe it or not, Yield Basis announced $5 million in funding in February—proof VCs are buying in.

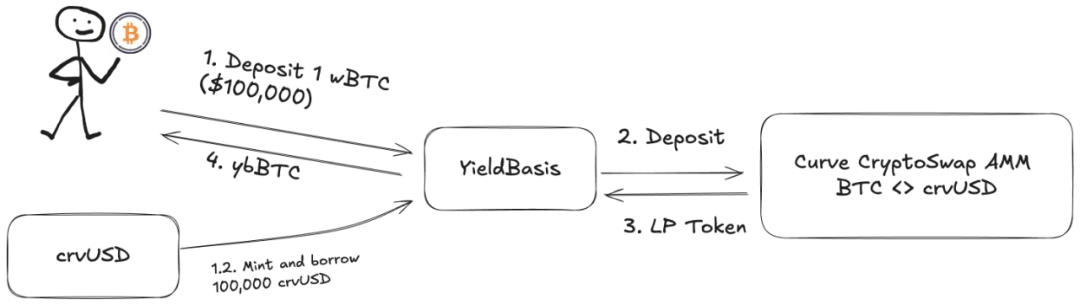

But here’s the catch: liquidity must always be paired in the BTC/crvUSD pool. It can’t be all BTC. Llama Lend and crvUSD jointly solve this with a dual lending design:

- Users deposit (cbBTC/tBTC/wBTC) totaling 500 BTC. YB (Yield Basis) borrows 500 crvUSD using flash loans—not a full CDP (normally about 200% collateral ratio).

- YB places 500 BTC and 500 crvUSD into the Curve BTC/crvUSD pool and mints $ybBTC as the liquidity share.

- YB uses this $1,000 LP share as collateral to borrow 500 more crvUSD via Llama Lend’s CDP, paying back the original loan.

- The user gets $1,000 worth of ybBTC; Llama Lend holds $1,000 of collateral and wipes out the first loan; the Curve pool gets extra liquidity—500 BTC and 500 crvUSD.

Caption: How YB Works

Source: @yieldbasis

In the end, 500 BTC cancels its loan and delivers $1,000 of LP shares—achieving 2x leverage. But that crucial parity loan is issued by YB itself, acting as the go-between. Ultimately, YB absorbs the remaining $500 in debt from Llama Lend, so YB must also share in Curve’s fee revenue.

If you think 500U of BTC will yield $1,000 in trading fees, that’s half-right. But you won’t keep all of it. The split isn’t even—YB’s design is a detailed tribute to Curve’s model.

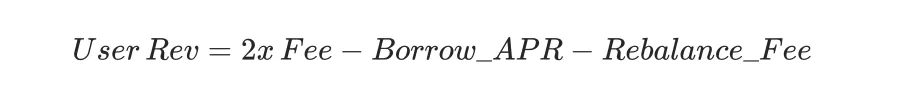

Let’s break down the prospective yield:

2x Fee means 500U in BTC generates $1,000 in fees. Borrow_APR is Llama Lend’s interest; Rebalance_Fee is the cost to arbitrageurs for maintaining 2x leverage—ultimately charged to LPs.

Here’s the good and bad news:

- • Good: All Llama Lend borrowing revenue goes back to the Curve pool, passively boosting LP returns.

- • Bad: Only half the pool’s fees go to the pool; LPs and YB split the other half.

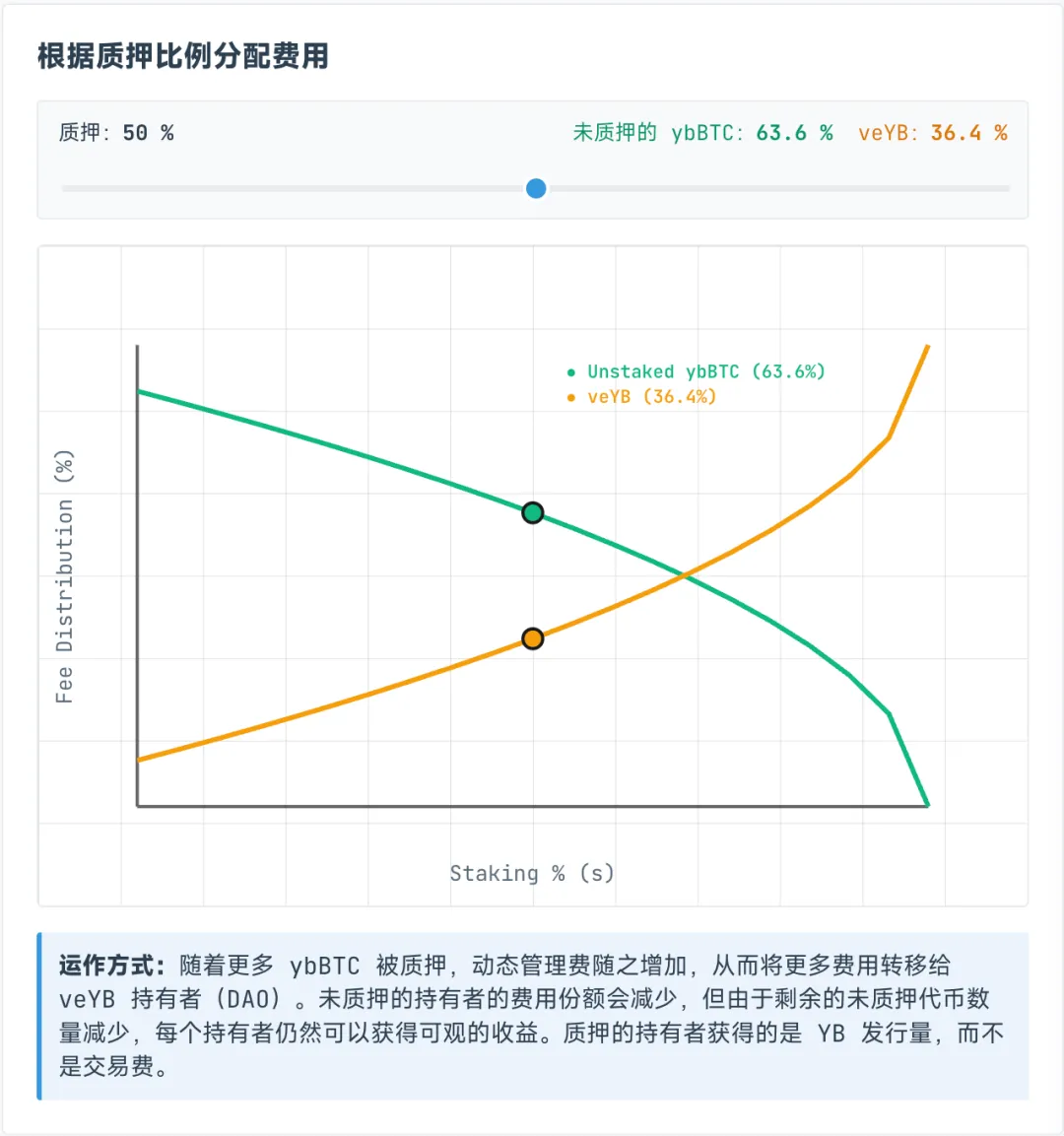

Fees to veYB are dynamic, split between ybBTC and veYB holders. veYB always gets at least a 10% minimum share. If no one stakes ybBTC, you only get 45% of fees—veYB (YB) keeps 5%.

Here’s the twist—even if users don’t stake ybBTC with YB, their max share is 45% of pool fees. Stake ybBTC to earn YB tokens, but you’ll forgo those fees. To get both, stake YB for veYB and collect fees.

Caption: ybBTC & veYB Revenue Sharing

Source: @yieldbasis

Impermanent loss is not eliminated—just moved.

Your 500U in BTC may double your market-making power, but YB never promised all that yield comes to you. After staking for veYB, it takes two steps (veYB → YB, ybBTC → wBTC) to recover your capital and profits.

To get full veYB governance (bribery mechanism), you’re locked up for four years. Otherwise, voting power and yield gradually decrease with shorter lockups. Whether four years of illiquidity for YB tokens is worth it depends on your outlook.

As noted above, impermanent loss is just an accounting entry—as long as you don’t withdraw, it’s an unrealized loss. YB’s “solution” is also “book income”—it just offers you marked-to-market gains as a holding yield, building its own economic narrative.

You want to use 500U to generate $1,000 in fees; YB wants to “lock” your BTC and sell you YB tokens.

Multiparty Collaboration and the Growth Flywheel

The yield boom is here—if you have big dreams, it’s your time.

Curve and crvUSD provide a boost to $CRV, but also launch Yield Basis and the $YB token. Will YB keep value or appreciate after four years? Probably not…

Beneath Yield Basis’s complex design, the real story is crvUSD’s path to wider adoption.

Llama Lend is part of Curve at its core. Yet Curve’s founder proposed minting $60 million crvUSD to seed YB’s liquidity—an aggressive gambit.

Caption: YB Waits While crvUSD Is Issued

Source: @newmichwill

YB will deliver rewards to Curve and $veCRV holders, but YB token’s pricing and appreciation is the real question. crvUSD is just “U” by another name—so is YB genuinely a growth asset?

Another “ReSupply” event could hit Curve directly.

So, this article skips YB–Curve tokenomics and fee sharing. The $CRV lessons are fresh; $YB won’t hold value, so why waste the bytes?

Yet, Michael’s self-minting defense is inventive: user-deposited BTC “mints” equal-value crvUSD, boosting total crvUSD in circulation, each one earning fees in the pools—a real business use case.

But these crvUSD reserves are only at parity—not excess collateral. If you can’t raise reserves, boosting crvUSD’s earning power is the only play. Remember the capital return metric?

Michael’s vision is borrowed crvUSD working with existing pools—wBTC/crvUSD connects with crvUSD/USDC, lifting both pairs’ trading volume.

crvUSD/USDC splits fees 50/50: half to $veCRV holders, half to LPs.

This is risky: Llama Lend’s crvUSD is reserved for YB, but crvUSD/USDC pools are open-entry. Here, crvUSD’s reserves are too thin. Any price swing opens it to exploitation, risking a death spiral. If crvUSD fails, YB and Llama Lend fall too, shaking the whole Curve ecosystem.

Key point: crvUSD and YB are tightly connected. Half of all new liquidity must enter YB’s realm. While crvUSD issued to YB is technically separated, its use isn’t—Curve’s core risk and potential flashpoint.

Caption: Curve Fee Distribution Plan

Source: @newmichwill

Michael’s proposal: use 25% of YB token supply to “bribe” stablecoin pools for liquidity. It’s almost comical. Asset safety: BTC > crvUSD > CRV > YB. When trouble hits, YB can’t even save itself—let alone anyone else.

YB’s issuance is just fee revenue from the crvUSD/BTC pool. Think Luna-UST: UST was minted in step with Luna burns; YB Token’s relationship to crvUSD is similar.

It’s even closer than you think. Michael, citing six years of BTC/USD trading and pricing, claims a 20% APR is sustainable, even 10% in a bear market, with 2021 bull runs yielding 60%. Give crvUSD and scrvUSD just a bit of that power, and he believes they can overtake USDe and sUSDe.

I can’t verify that with backtesting. But remember: UST also “guaranteed” 20% yields, and the Anchor + Abracadabra model lasted for years. Is YB + Curve + crvUSD really different?

At least UST bought BTC as reserves before its collapse; YB uses BTC directly as leveraged collateral—a big step forward.

Forgetting is betrayal.

Starting with Ethena, on-chain projects began seeking real yields instead of chasing speculative narratives.

Ethena uses CEX hedges to harvest ETH yield; distributes via sUSDe; maintains big holders’ confidence with $ENA treasury strategy—keeping USDe issuance above $10 billion.

YB wants real trading income, which is fair—but trading and lending are fundamentally different. Trading is instantaneous, and every crvUSD is a joint liability of YB and Curve. All collateral comes from users; there’s almost no native capital at risk.

crvUSD supply is currently low—so spinning up a yield flywheel and 20% APY is easy for now. But once it scales, drops in YB price, BTC price swings, or weak crvUSD value-capture could all trigger massive sell pressure.

The dollar is unbacked—and crvUSD is heading the same way.

Still, DeFi’s composability risk is now priced into the whole on-chain system. When everyone carries risk, nobody really does—those who stay out will just absorb the next collapse by default.

Conclusion

Everyone gets a shot to shine—whether you seize it makes you a hero.

In traditional finance, yield basis refers to Treasury yields. On-chain, will the “yield basis” be BTC/crvUSD?

YB’s logic only stands if on-chain trading is huge—especially if Curve’s volumes remain high. Only with deep, uninterrupted trading does eliminating impermanent loss make sense. Consider:

- • Power generation equals consumption—no idle “electricity”; generation matches use, instantly.

- • Trading volume equals market cap; every token is in motion, constantly traded.

Only with robust, flowing trading does BTC price discovery occur and crvUSD’s value logic hold. Mint from BTC loans, profit from BTC trading—I’m bullish on BTC long-term.

BTC is crypto’s CMB (Cosmic Microwave Background). Since the 2008 financial “big bang,” unless we reset the world by revolution or nuclear war, BTC will trend up—not necessarily because of growing confidence in BTC itself, but because of continued faith (and inflation) in the dollar and fiat money in general.

I trust Curve’s technical chops moderately at best; the Resupply fiasco shook my trust in their ethics. Still, few teams dare to innovate in this space. Money always moves, and impermanent loss will always find new believers.

UST bought BTC before its collapse; USDe swapped reserves for USDC during volatility; Sky went all-in on Treasuries. Here’s wishing Yield Basis good luck this time.

Disclaimer:

- This article is republished from [Zuoye WaiBoShan], with all rights reserved to the original author [Zuoye WaiBoShan]. For concerns about republication, please contact the Gate Learn team, who will respond promptly in line with our policies.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice of any kind.

- Other language versions are translated by the Gate Learn team. Unless Gate is cited, translated versions may not be copied, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0